There are several approaches when it comes to portfolio adjustment or asset allocation determination. The best one may depend on specific financial circumstances, risk tolerance, financial objectives, and investment time horizon. Today, we bring you Benjamin Graham’s formula (100 minus age) so you can decide the number of stocks most convenient for you to own according to your age. Let’s learn how you can adjust your portfolio with Graham’s formula and how many stocks you should have according to your age.

Graham’s formula

First of all, let’s make clear what asset allocation means: it’s how investors divide their portfolios among various asset classes such as stocks, bonds, cash, commodities, real estate, etc.

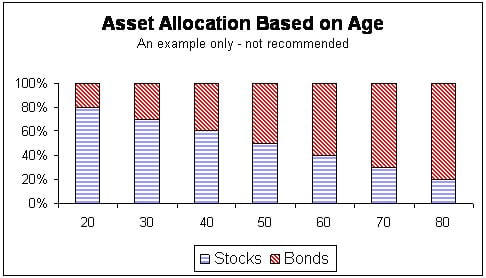

Now, Benjamin Graham is a well-known figure in the investments realm because of his contributions to the community; among his books, we remark The Intelligent Investor, in which he proposes his famous formula “100 minus age”. It consists of subtracting the number of your age in years to 100 and using the result as the percentage of stocks you should invest in.

If you are 30 years old, the formula comes to 100 – 30 = 70 so the 70% of your investment portfolio should be in stocks, the other 30% could be in bonds or other assets. This approach suggests a major exposure to stocks in the youth, when more risk can be tolerated, and a major security in bonds (or other more stable assets) as the investor ages. By the way, this doesn’t mean that stocks can’t be safe, as we explained in a previous article.

Age-Based Investment Strategy

In your 20s and 30s, you have a longer time horizon for your investments to grow, allowing you to take on more risk with a higher proportion of stocks. Stocks typically offer higher returns compared to bonds, making them ideal for younger investors aiming for aggressive growth. At this stage, it’s crucial to diversify your stock investments to maximize potential gains while mitigating risks. Although bonds might play a minor role in your portfolio, their inclusion can still provide a safety net against market volatility.

As you approach your 40s and 50s, your investment strategy should begin to shift towards a more balanced approach, gradually increasing your allocation to bonds. This transition helps to protect the wealth you’ve accumulated while still allowing for growth through stock investments.

In your 60s and beyond, the primary focus of your investment strategy should be on preserving capital and ensuring a steady income stream. This means significantly increasing the allocation to bonds, which offer lower risk and more predictable returns compared to stocks. The emphasis should be on low-risk investments that safeguard your retirement funds.

Advantages and Disadvantages

On the one hand, one of the evident advantages of this formula is the simplified investment decision-making, as it provides a clear and easy-to-follow guide for investors seeking proper asset diversification. It notably helps balance risk and increase financial security; by reducing the number of stocks over time, it decreases volatility and protects accumulated capital.

On the other hand, one of the main disadvantages is that it does not take into account the individual circumstances of the investor, such as their specific financial goals, personal risk tolerance, and economic situation, nor does it consider market dynamics and changes in the economy. We know that these factors can profoundly affect the performance of our investments.

Conclusion

As we saw, it’s very simple how you can adjust your portfolio with Graham’s formula and how it works to determine how many stocks you should have according to your age; it just comes down to subtracting the investor’s age from 100 to determine what percentage of your portfolio should be invested in stocks. It’s a simple and accessible approach for investors seeking to balance risk and security in their portfolios throughout their lives.

It can be very useful as a starting point or as a general rule (rather than a golden rule) to apply in moments of confusion. However, it is important to understand its limitations. Ultimately, the key to a successful investment strategy lies in balance and continuous adaptation to individual needs and market dynamics.

0 Comments