The stock market emerges as a promising option for those looking to start investing, and initially, it may seem like an intimidating world due to its apparent complexity. However, it is, in fact, becoming increasingly user-friendly for those without prior experience. That’s why today, we aim to address some questions that may arise when venturing into investment through buying and selling stocks. So, how do you invest in stocks as a beginner?

WHAT ARE STOCKS?

First of all, let’s define stocks (or shares) as a partial ownership of a company. When someone owns shares of a company, they become a shareholder and share a proportional part of the company’s assets and profits. In a simplified but accurate manner, we can say that the functioning of the stock market is as follows: companies listed on the stock exchange, seeking funding, raise capital by selling their shares, while investors, looking to profit from their money, earn returns by becoming shareholders.

Companies issue shares that investors buy and sell on the stock market through brokers, at a price determined by supply and demand. Thus, shareholders benefit from the appreciation of stock prices; as the price rises, their wealth increases.

FINANCIAL PROFILE

To start investing in stocks on the right foot, it is crucial to have a clear understanding of one’s financial profile. This includes accurately determining financial goals, available budget, investment timeframe, and risk tolerance. Several factors influence this matter. At TBI, we believe the best way to address them is to take a moment for honest reflection on one’s current situation, be realistic about economic objectives, and maintain discipline in following the plan for their achievement.

Now, we would like to clarify the mentioned risk tolerance. The truth is, nobody wants to lose money, but every investment involves risk. However, some investments are riskier because their prices are more volatile –meaning they go up and down quickly– (for example, cryptocurrencies), while others are less risky because their prices are more stable (for example, government bonds). It is important to understand the volatility of the stock market and consider long-term investment as a strategy to mitigate risks, as this makes price fluctuations less relevant over time.

At TBI we like to define high risk investments not as investments but as speculation, speculation is fun, we get it, but it won’t make you rich (if you’re going to do it anyway at least don’t put more than 5% of your total investments at this risk). Very low risk investments like treasury bonds or similar acts as a hedge against inflation and it won’t make you rich either. Summarizing, if you want to learn how to invest in stocks, independently of your risk tolerance, invest in real businesses, diversify your portfolio and invest for a middle or long-term horizon.

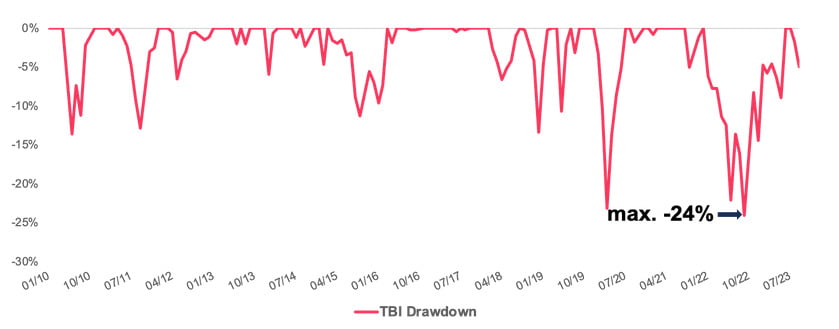

It is essential, therefore, to establish clear financial goals that provide direction and help guide investment decisions toward specific outcomes, estimate your optimal amount of monthly investment and check the effect of compound interest in our investment planning section; to recognize one’s risk tolerance find the risk report of a fund you’d like invest in and check the Drawdown analysis (this analysis gives you a metric of the maximum possible loss that could be reached, it measures the difference between each moment value and the previous highest value), find below the Drawdown figure for TBI and see that it took less than a year (from October 2022 to June 2023) to recover from that low level to the previous peak value, not quitting in bad times is a key part of investing and obtaining profits with time.

All these strategies and reading will make our entry and stay in the stock market more enjoyable, avoiding some unpleasant surprises due to disorganization and lack of knowledge.

HOW TO OPEN A BROKER ACCOUNT?

What is a broker? It is an intermediary between the investor and the stock market, making the buying and selling of stocks possible. Their main function is to execute transactions on behalf of investors, but they can also provide additional services such as financial advice, market research, and trading platforms. In simpler terms: a broker is a financial institution where you deposit funds to buy or sell stocks, bonds or other financial assets.

Each broker has its own characteristics, so it’s best to select a broker that aligns with your financial profile, considering your specific needs and objectives. And also contemplating some factors such as fees and commissions, minimum amount and deposit methods, friendliness of the platform, security and regulation.

Some of the best brokers to invest in stocks are:

- eToro

- Robinhood

- Interactive Brokers

- Fidelity Investments

- E*TRADE

INVESTMENT STRATEGIES for beginners

To make the most of our time and money invested in the stock market, it is important to understand some terms related with financial strategies like: portfolio diversification, short term (active hand) vs long term (set it and forget it) approaches, and stock analysis – fundamental and technical.

Diversification involves spreading the investment (funds) across a variety of assets, such as stocks from different companies or sectors. This allows mitigating potential losses by reducing the risk associated with the volatility of a single stock and taking advantage of growth opportunities in various areas of the market without relying exclusively on a single asset.

While a long term focus will always be our best ally in building solid and sustainable wealth over time -boost by compound interest-, there are also short term investments that seek to capitalize on rapid market movements, like intra-day or short term trading. These are often high risk investments, and as mentioned earlier, we do not recommend them because they involve speculation.

There are two ways to approach the stocks you own: “active hand” or “set it and forget it”. An active approach involves regularly monitoring and adjusting the portfolio in response to short term market changes. On the other hand, the “set it and forget it” approach involves building a solid portfolio and maintaining it for the long term, trusting that diversification and the quality of chosen assets will yield positive results over time; it requires the discipline to resist the temptation to react or try to anticipate the next stock market move. Logically, an active approach requires higher knowledge and more time, reasons why we don’t recommend this approach for beginners that are just learning how to invest in stocks.

Finally, there are two methods of analysis in the stock market: fundamental analysis and technical analysis. Fundamental analysis focuses on evaluating the financial health and growth potential of a company by examining fundamental data such as revenue, earnings, debt, expansion plans, and management reports; it can be useful for determining whether the price of a specific stock at a given time is overvalued or undervalued. On the other hand, technical analysis relies on the study of historical price patterns and trading volumes, focusing more on market trends and stock charts, with the goal of predicting future market trend.

PORTFOLIO MONITORING

Once we have bought stocks and diversified our portfolio, monitoring and periodic adjustments come into play as ways to preserve the success of our portfolio. This involves determining a monitoring frequency, evaluating the performance of our assets in relation to our goals, and rebalancing the portfolio if necessary.

Staying informed about market conditions, economic and political indicators, and any factors that may impact the performance of our portfolio is crucial. These habits constitute a process of risk assessment and identification of growth opportunities, culminating in effective management of our investments.

This regular monitoring and adjustment not only drives the adaptability of the portfolio but also provides the opportunity to learn and refine investment strategies as financial circumstances evolve. Ultimately, it allows us to continue steadfastly on the path toward achieving our long term financial goals.

ADDITIONAL RESOURCES

Thankfully, the investment assistance for beginners that are adventuring in this world is increasingly growing nowadays. One can access numerous platforms that provide educational data and financial advice.

At TBI, we offer an ideal service through a user-friendly platform for beginners looking to learn how to invest in stocks or starting in this field with the hope of building wealth and achieving their financial goals.

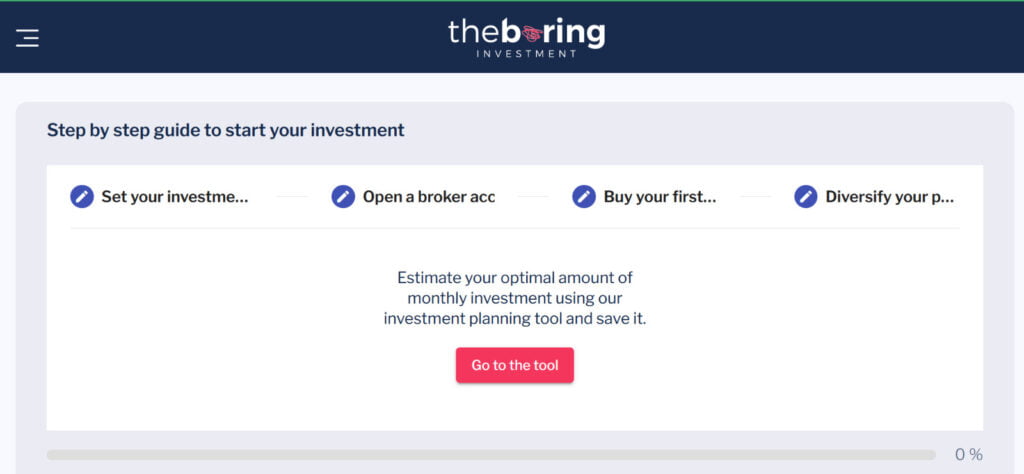

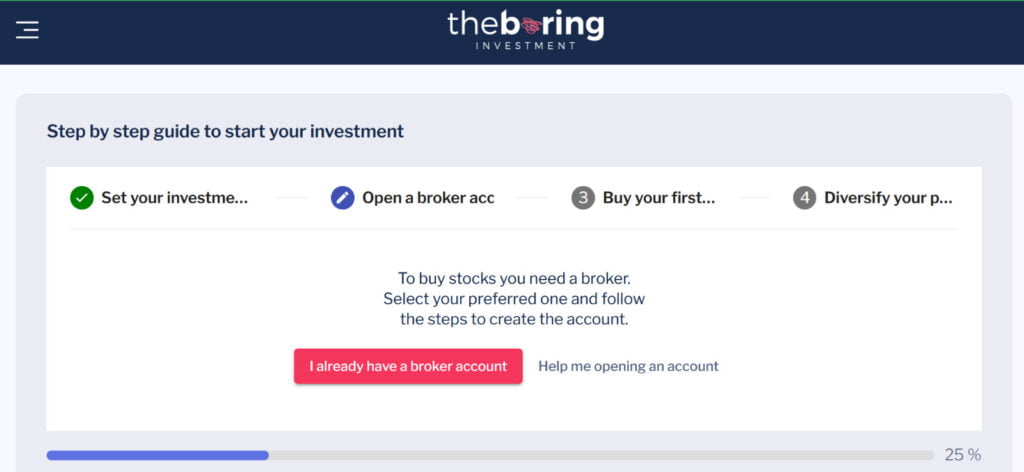

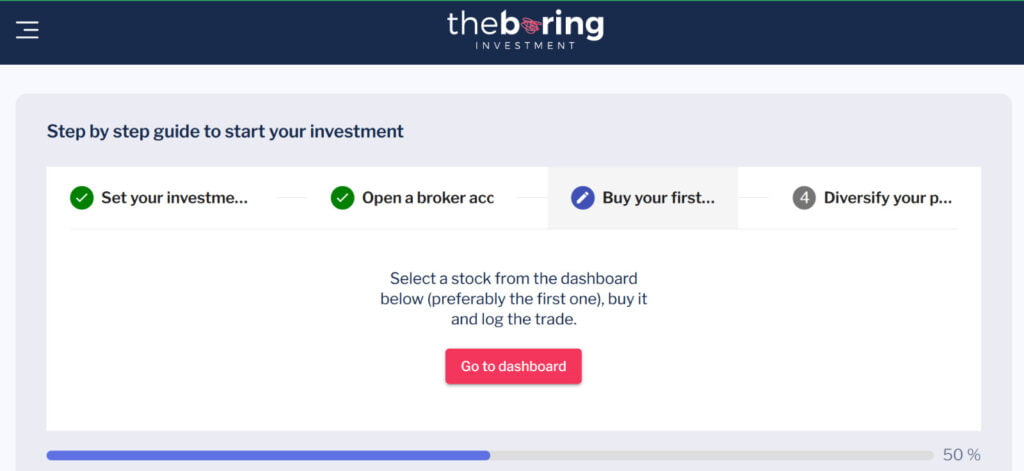

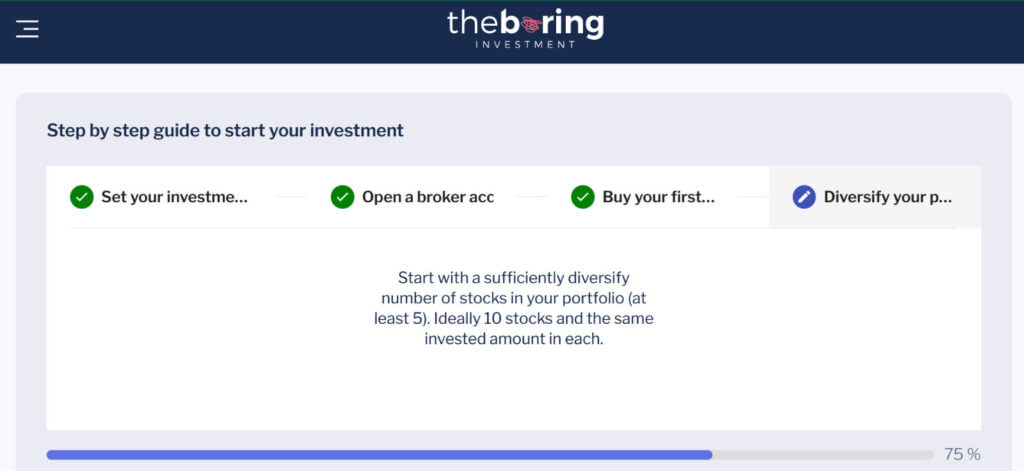

We even have a tool to start investing in 4 simple steps (register for free in the app to see the following feature):

1. Set your investment goals

2. Open a broker account

3. Buy your first sock

4. Diversify your portfolio

Our top-ranked stocks are profitable companies, large enough, and at a low market price. These are companies with good management and financial solidity. We use our own algorithm to build a financial score and identify companies that will not have any liquidity or solvency issue

We have conducted numerous analyses on our dashboard to assess our investments and have concluded that the return, while considering some volatility, averages 14% annually. It is an excellent opportunity for those seeking returns on their savings regardless of your experience in the subject.

By leveraging these additional resources, beginners can approach stock market investment with confidence and gradually build a solid foundation of knowledge and skills.

CONCLUSION

Having explained what stocks are and their basic functioning, we’ve laid the foundation to further develop some fundamental concepts that beginner investors should be aware of. The initial steps include determining one’s financial profile, considering financial goals, available budget, investment timeframe, and risk tolerance -with the relevant clarification on this last matter-; and opening an account with a broker, the intermediary between the investor and the stock market, through which financial transactions are executed.

To succeed in the process, we propose some financial strategies such as portfolio diversification, adopting short term (active hand) and long term (set it and forget it) approaches, and conducting stock analysis – both fundamental and technical. Additionally, we emphasize the importance of portfolio monitoring and periodic adjustments based on market changes.

We conclude with an additional resource such as the professional financial advisory service provided by TBI, from an easy-access platform, very simple to use, dynamic and visually attractive.

We hope to have showed how to invest en stocks for beginners, addressed common questions that arise when starting to invest and successfully outlined the fundamental guidelines that anyone looking to take control of their financial future should consider. We understand that the beginning of this investment process can be intimidating, but it is undoubtedly a challenge worth undertaking. We recommend patience and calmness, as over time, it will become increasingly easier, allowing you to enjoy the fruits of a job well done.

Schedule time with an expert

0 Comments