We have heard that inflation is something affecting the majority of people and governments around the world, putting at risk the value of our money… But what is inflation? How does it affect our daily lives? Why our money loses value over time? Is there a way to mitigate its negative results? Today, we aim to clarify this issue by answering those questions.

What is inflation?

First of all, Inflation is a macroeconomic phenomenon that gradually reduces the value of money, leading to a constant increase in the cost of goods and services, directly impacting saved funds and all sectors of the economy in general.

This erosion of purchasing power can have significant implications for individuals, businesses, and the economy as a whole. With the rise of price levels, each unit of currency declines, meaning that you can buy fewer goods and services with the same amount of money. It’s affecting your savings, reducing your standard of living, and increasing your cost of living.

If you keep your money in your bank account (or in cash), or, let’s say, you are saving every penny you can, leaving it stagnant, you are being affected by inflation. In other words, if you are not doing anything to contra-rest the effects of inflation: you are losing money.

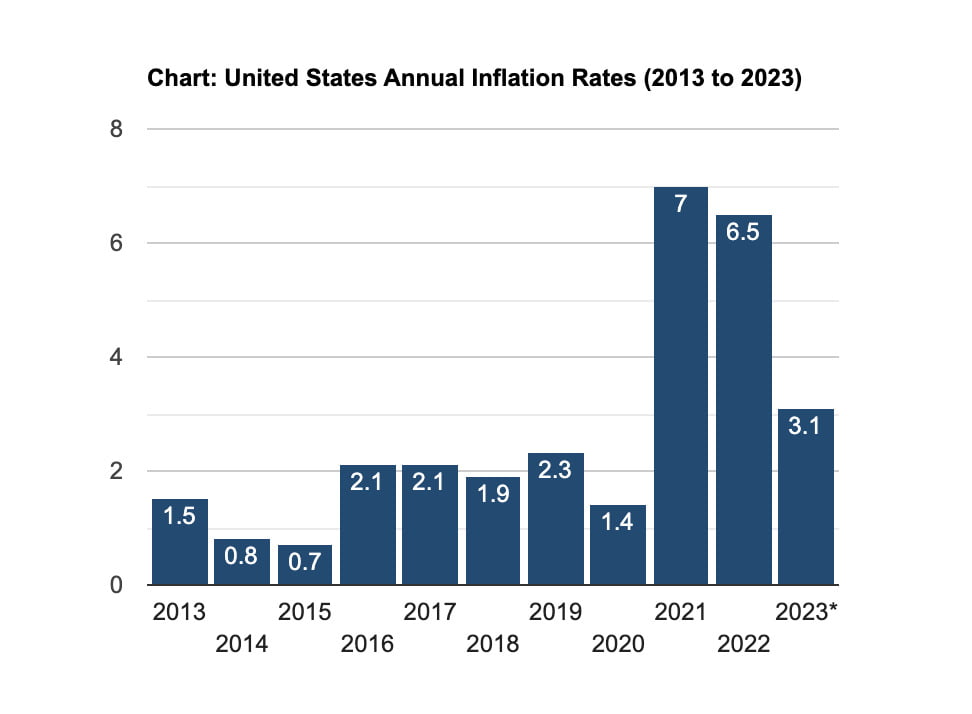

Although it may sound catastrophic, it’s a totally normal thing that occurs -at different rates- in every country in the world. Even though it’s influenced by several economic, monetary, and external factors, it happens primarily due to changes in the supply and demand dynamics. Luckily, this is not a lost battle, as we mentioned, there is something you can do about it.

How to win against inflation?

Beating inflation requires a strategic approach to manage your money, with smart financial choices and solid investments.

A good idea is to invest in assets that have historically outpaced inflation over the long term. With a diversified portfolio, you can ensure that your investments continue to perform well even if certain sectors or asset classes experience inflationary pressures. Lastly, have patience and trust the process.

Historically, 78% of the time stocks outpaced inflation, more times than a bond portfolio, which makes stocks the best strategy against inflation.

With that said, you should ensure that your savings are earning some return that can offset at least part of the inflation rate: returns that are greater than the inflation rate will give you positive net growth, returns equal to the inflation rate will offset inflation’s impact, and even if your investment return is less than the inflation rate, you’re still protecting the value of your money to some extent.

As you see, there are ways to better position yourself to protect your wealth and achieve your long-term financial goals despite the challenges posed by inflation.

An example

Let’s assume a 5% yearly inflation rate and a budget of $10,000.

If you decide to save that amount without investing it, leaving it stagnant, after just one year you would lose $500 in terms of purchasing power (you will still have the $10,000, but it will be worth less).

In contrast, if you decide to invest the $10,000 in a diversified portfolio of stocks with an average annual performance history of 10%, you could mitigate the negative impact of inflation and potentially increase your wealth over time. After one year, your investment could grow to $11,000, making a profit of $1,000, conserving, and even increasing your purchase power.

Conclusion

We have clarified how inflation produces a powerful influence on the value of our money, erasing our purchase power over time. Nevertheless, through smart investment strategies, we can resist this inflationary force and protect the value of our financial assets. Investing in stocks that historically supersede the inflation rate is a great strategy to preserve -and even augment- our wealth over time. With a long-term perspective and a diversified portfolio to stay solid against inflation shocks, you are going in the right direction.

We hope to have explained correctly why your money loses value over time due to inflation and what can you do about it.

As you see, there are ways to better position yourself to protect your wealth and achieve your long-term financial goals despite the challenges posed by inflation.

0 Comments