We might learn about inflationary periods in books or news, but we definitely experience it at the grocery store. We know inflation is a macroeconomic phenomenon that gradually reduces the value of money, leading to a constant increase in the cost of goods and services, directly impacting saved funds and all sectors of the economy in general.

Today, we’ll focus on how to deal with inflationary periods while investing so we can determine the best investment during inflation.

Investments and Inflation

When prices rise, the purchasing power of our money decreases and our cost of living increases. If you keep your money in your bank account (or in cash), you are losing money.

That’s why it’s necessary to seek assets that can preserve the value of our wealth. Ideally, your investments should have higher returns than the inflationary index. But we know this isn’t always the case, nevertheless, you are still in a more favorable situation than those who don’t invest. You don’t want to see the value of your money decreasing in front of your eyes.

To learn how your money loses value over time due to inflation check our previous article.

There are a lot of sectors where you can invest, we will recommend a few.

The best investments during inflation

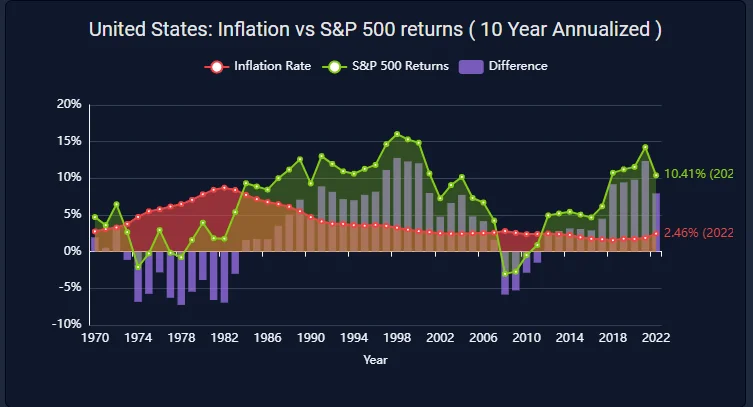

- Stocks: the best strategy against inflation. Historically, 78% of the time stocks outpaced inflation, more times than a bond portfolio. Even the fall down that stocks may have by product of the increase in interest rates, is followed by a comeback from the loss, eventually surpassing the inflation levels. It’s important to consider companies with growth potential, companies with strong pricing power and companies that can raise their prices in response to inflation, which can lead to higher revenues and profit.

- Real estate or REITs: property is a finite resource, and as the cost of goods and services rises, so does the value of land and buildings. You can invest in real estate directly – which requires a higher first investment and higher maintenance costs. Or through a REIT (Real Estate Investment Trust); over the last decade, the MSCI U.S. REIT Index has had an average annual return of more than 10%.

- Commodities that work as value reserves: precious metals, like gold and silver, tend to rise in value -because of their durability and rarity- as inflation increases, providing a shield against the erosion of the purchasing power of money. This is why they are good options for keeping value during inflationary periods.

- TIPS (Treasury Inflation-Protected Securities): government-issued security bonds designed to adjust with inflation levels. Their unique structure allows them to adjust payments based on the inflation data; if inflation increases the interest rate you earn on these bonds increases as well, ensuring that you maintain your purchasing power even when the general price level is increasing.

The worst investments during inflation

As well as there are the best, there are some assets we wouldn’t recommend you:

- Cash or savings: in inflationary periods, the value of cash diminishes as inflation increases and the cost of living augments, resulting in a loss of wealth for those who hold large amounts of cash. If you have your savings in a bank account it’s the same story.

- Fixed-rate debt securities: the income they generate remains constant, regardless of changes in inflation, so when inflation increases, the purchasing power of the interest payments diminishes. For example, if you own a bond that pays 3% annually and inflation rises to 6%, the real return on your investment is negative, as the income generated is not enough to keep up with the increased cost of living.

- Companies with weak pricing power: companies that cannot pass on their costs to consumers by raising the prices of their goods and services when their costs increase due to inflation. If they do increase their prices, demand for their products decreases because there are multiple substitutes available on the market.

- Commodities that don’t work as value reserves: agricultural products like corn or coffee are not a good idea to invest in during periods of inflation because they are perishable, which affects their long-term value. Also, their prices can be highly volatile, influenced by seasonal changes, weather conditions, and short-term supply and demand fluctuations.

Conclusion

Navigating the financial landscape during inflationary periods requires careful consideration of how different assets respond to rising prices. As we’ve discussed, inflation can erode the purchasing power of money, making it essential for you to strategically invest your money to maintain and grow your wealth.

On the one hand, assets like stocks, real estate, commodities, and TIPS consolidate as the best investments during inflation. These tend to either appreciate in value or offer returns that outpace inflation, making them effective tools for preserving wealth.

On the other hand, holding large amounts of cash or investing in fixed-rate debt securities are bad ideas during inflationary periods, as these assets typically lose value in real terms when prices rise. The key is to focus on investments that either directly benefit from inflation or have built-in mechanisms to adjust for it.

In conclusion, stocks consolidate as the best investment during inflation. With the power of compound interest, a diversified portfolio, and the adherence to a long-term investing plan you can not only go through market fluctuations but also win against inflation and preserve or augment your wealth.

If you want to start investing in a friendly platform with the help of professionals and beat inflation, join us.

0 Comments