The investment world is one in which theory and practice go hand in hand, but it is very important to consider also the psychological aspect of value investment, it requires patience and discipline not to get caught up in the trap of instant gratification and to resist the market fluctuations. That’s what we will focus on today, the psychological aspect of value investing: patience and discipline.

Psychological challenges – The impact of fear and greed

Fear and greed are two of the most powerful emotions that can significantly influence investment decisions, often leading investors to buy or sell at the wrong time. Markets can be volatile and unpredictable. Prices can fluctuate wildly in response to various factors, such as economic indicators or geopolitical events. During these turbulent times, it is tempting to react impulsively and make irrational decisions based on short-term market movements.

On the one hand, fear normally appears during market downturns, and it can cause investors to panic and sell off assets at a loss, even when most of the conditions that motivated the investment in the first place remain solid. This irrational behavior is driven by a desire to avoid further losses, but it often results in missing out on potential recoveries. The cyclical nature of markets means that downturns are usually followed by recoveries, and selling in a panic can lock in losses that would otherwise be temporary.

On the other hand, greed can drive investors to take unnecessary risks, especially during bullish markets. The fear of missing out (FOMO) can lead to overconfidence, pushing investors to buy overvalued stocks in the hope of quick profits. This behavior is often seen during market bubbles, where the desire for rapid gains blinds investors to the underlying risks. Greed can also result in holding onto winning positions for too long, ignoring signs that it might be time to sell. This can lead to significant losses when the market eventually corrects.

There are three concepts that can explain this behavior:

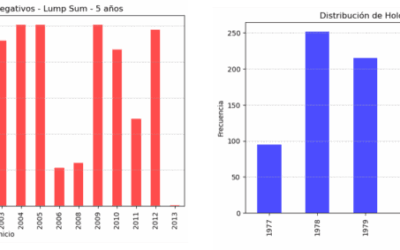

- Loss aversion. People fear losses more than they appreciate gains. About this, there is a very interesting article that critiques the expected utility theory as a descriptive model of decision making under risk written by nobel prize winners Daniel Kahneman and Amos Tversky in 1979. It’s called “Prospect Theory: An Analysis of Decision under Risk”.

- Overconfidence. People tend to believe their abilities and knowledge are better than they actually are, undertaking risky investments, thinking they can outsmart the market.

- Anchoring. People rely heavily on an initial piece of information (the “anchor”) to make decisions, ignoring other important factors that can determine the best move.

Be patient.

In the world we live in, where instant gratification seems to be the norm, being patient is a challenge that requires strength, some kind of strength that is trained in a process of introspection and self-discovery that goes hand in hand with practical habits.

We know financial markets are volatile and inherently cyclical, experiencing periods of rapid growth followed by corrections or downturns. Being patient in these moments is crucial. Instead of succumbing to fear and selling off assets during market drops, recognize these corrections as opportunities to purchase undervalued stocks at lower prices. By remaining patient and strategically investing during these downturns, you can acquire high-quality assets at a lower cost, positioning yourself for substantial gains when the market eventually recovers.

Patience equals focus on the long-term perspective. By patiently waiting for the value of an investment to appreciate over time, investors can potentially unlock substantial returns. Don’t forget about the benefits of the compound interest and how it works: by holding investments over an extended period, the returns generated each year are reinvested, leading to exponential growth and substantial wealth over time.

When you focus on the long term, you aren’t perturbed by daily market fluctuations. You don’t anxiously check your portfolio every few minutes, and you don’t lose sleep over a single bad day in the market. Your mental peace isn’t held hostage by the unpredictable movements of the market.

Have discipline.

The same goes with discipline, it’s another cornerstone of successful value investing that requires strength and training. It is easy to get swayed by short-term market fluctuations that can trigger strong emotional responses, leading to rash actions such as panic selling during downturns or overbuying during bullish periods. Such reactions conclude in impulsive investment decisions that often result in financial losses and missed opportunities.

Discipline helps you avoid emotional or impulsive decisions, and keeps your focus on the objective that motivated the whole process in the first time. But it doesn’t only aid in achieving financial objectives, it also builds a mindset of stability and confidence. A mindset that will help you get through market’s (and life’s) ups and downs.

It begins with establishing clear investment criteria and adhering to them consistently, regardless of the market noise. By choosing an investment strategy like dollar cost average you are regularly investing a fixed amount of money into the market, despite its current state.

Keep in mind that discipline is not about suppressing emotions, but about acknowledging them and, at the same time, not allowing them to cloud your judgment.

A clear example of the rewards of discipline and patience in investing is the recovery of the stock market after the 2008 financial crisis. Investors who remained patient and disciplined while continuing to invest during the downturn saw significant returns as the market rebounded in subsequent years.

How to manage this psychological aspect

Managing the psychological aspect of value investing is crucial for maintaining a clear and focused mind. Mindfulness and stress management play a significant role in this process.

Mindfulness involves being present in the moment and aware of one’s thoughts, emotions, and surroundings – without judgment. In inversions, this means staying conscious of market movements and your own reactions to these changes without immediately reacting.

Stress management techniques are equally important to deal with the volatility and uncertainty of the stock market. Regular practices such as meditation, deep breathing exercises, and physical activity can help reduce stress levels and improve overall mental health. These activities help to calm the mind and body, allowing you to approach your decisions with a clearer perspective and reduced emotional interference.

By managing stress effectively and by practicing mindfulness, you can gain better control over your impulses, making it easier to have the patience to stick to the long-term investment strategy and have the discipline to avoid impulsive decisions driven by fear or greed.

Remember that incorporating these practices into an investing routine not only enhances decision-making but also contributes to a healthier and more balanced life. If you regularly practice these techniques, you will be better equipped to handle the emotional ups and downs of the market.

How TBI can help you

At TBI we truly believe in the importance of dealing with the psychological aspects of value investing: patience and discipline; as mentioned. And that’s why our service is articulated to help you. From reminders and alerts that we send you to keep track of your investment plan and to help you make decisions without being influenced by psychological factors, to our robust algorithm that allows you to gain confidence in the process to keep moving forward, and much more. We aim to make this apparently difficult process as friendly as possible. Don’t wait any longer and join us: https://theboringinvest.com/#/investment-board

Conclusion

On the surface, investing appears to be all about numbers, data and cold hard facts. However, those who explore its depths realize that investing is both a psychological journey and a financial one. It’s a perpetual dance between fear and greed, between the desire for immediate gratification and the discipline of patience.

Both fear and greed undermine the core principles of value investing, which emphasize patience and discipline. To be successful in this amazing practice of value investing, advocate for a long-term perspective and focus on the intrinsic value of investments rather than short-term market fluctuations or the momentary stock prices.

Overcoming these emotional challenges that surround inversions requires discipline, implying setting clear investment criteria and adhering to them regardless of the stock market conditions. That’s how you make rational decisions that align you with your long-term financial goals.

We hope to have made clear the importance of the psychological aspect of value investing: patience and discipline give you the fortitude to withstand short-term losses for long-term gains. Remember that “investing is a marathon, not a sprint”.

0 Comments