If you want to build wealth then a boring investment strategy is what you need. Among the various investment strategies you could find, the boring one, focused on long-term consistency (meaning not aiming to become rich from one day to the other or time the market) and minimize unnecessary risks, will be the best. But why is boring investing a successful strategy?

What is boring investing?

Boring investing refers to a strategy focused on consistency, stability, and long-term growth rather than chasing quick wins or market trends where excitement is often mistaken for opportunity.

Instead of trying to time the market or pick the next big stock, boring investors typically allocate their money to value stocks of well-established companies.

The goal is simple: build wealth gradually while minimizing unnecessary risks.

Focus on fundamentals

No hype

Companies that are worth investing in are not always the sexy or glamorous ones, this means that they tend to operate in mature industries, provide essential services, and deliver stable revenues with limited volatility. The one thing they lack is the hype that goes with rapid increase in stock prices – usually followed by abrupt downfalls.

Stocks that constitute a boring investing strategy often lack the kind of explosive short-term upside that drives social media chatter, and as a result, they’re sometimes undervalued or simply overlooked, and this is the moment when you should buy those stocks.

If you want to make sure that your investment decision is on the right track, put money into well-established companies with strong financials, predictable earnings, competitive advantages and most importantly priced in the market at a reasonable or cheap price. These aren’t the trendy “hot stocks,” but over time, they tend to deliver solid and sustainable returns.

Warren Buffet once said:

“The good news I can tell you is that to be a great investor you don’t have to have a terrific IQ. If you’ve got 160 IQ, sell 30 points to somebody else because you won’t need it in investing. What you do need is the right temperament. You need to be able to detach yourself from the views of others or the opinions of others.

You need to be able to look at the facts about a business, about an industry, and evaluate a business unaffected by what other people think. That is very difficult for most people.

Most people have, sometimes, a herd mentality which can, under certain circumstances, develop into delusional behavior. You saw that in the Internet craze and so on. I’m sure everybody in this room has the intelligence to do extremely well in investments.”

Unnecessary risks

Even when there’s always some level of uncertainty, value stocks or boring investments are a safer choice than those known as short-term growth stocks because they rely on current financial strength rather than speculation of future earnings potential.

If you want to avoid unnecessary risks like unpredictable swings, major losses, and the anxiety inherent to volatile stocks that are more sensitive to market fluctuations and economic downturns, then you should invest your money in stocks that are backed by solid fundamentals. This traces a path toward success in the long term.

Identifying and investing in bargain stocks gives you a margin of safety. To know precisely how to identify value stocks, check our previous article!

The power of compound interest

Dollar Cost Average

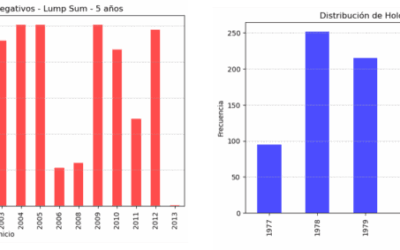

The boring investment benefits from the potential of compound interest where returns are reinvested and generate more profits over time. This strategy is known as Dollar Cost Average. It might seem boring to invest every month the same amount of money, but in the end, you are building wealth and following the market rate without effort.

When you set up automatic contributions to your investments, you will buy more shares when prices are low and buy fewer shares when prices are high. More importantly, you will continue to buy investments when the sky seems to be falling. The worse the stock market has done recently, the more likely you will see above average returns going forward.

Long term strategy

The role of patience and discipline

When your strategy isn’t based on hype or fear, you’re less likely to make impulsive decisions. Boring investing helps you avoid the traps of market timing, panic selling, or chasing unrealistic returns. Staying calm and sticking to a disciplined plan -even when markets are volatile- is one of the biggest advantages in the long run.

While it may lack the thrill of speculative trading or trying to outguess the market, boring investing offers something far more valuable: peace of mind and a higher probability of achieving financial goals. It’s about building a resilient foundation for long-term wealth, trusting that slow, deliberate moves often outperform reckless speed in the unpredictable world of investing.

If you want to read more about the psychological aspect of value investing: patience and discipline, check our previous article!

Conclusion

Why are we The Boring Investment?

We think that the passionate world of investments should be available for everybody. You don’t need to be an expert on finance to become wealthy by putting your money to work for you.

For us, boring equals simple and valuable. The boring investment is driven by the wish to help you become free. Financial freedom is achievable with little effort, you just have to stick to a boring but efficient plan.

We believe in long-term consistency, low risk, and rational decision-making over short-term excitement or speculation.Let us do the hard work of finding the best investments for you and join us now!

0 Comments